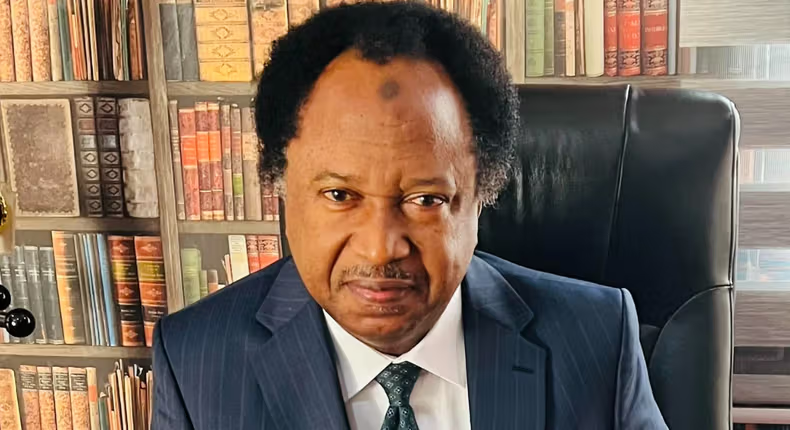

Human rights activist and former National Assembly member Shehu Sani has voiced his concerns regarding the Enugu State government’s recent decision to impose taxes on corpses in morgues. The Enugu State Internal Revenue Service (ESIRS) issued a circular announcing a ₦40 daily tax for each deceased individual not buried within 24 hours.

The directive is in accordance with section 34 of the Birth, Deaths and Burials Law Cap 15 Revised Laws of Enugu State 2004. According to the circular, “the sum of ₦40.00 only is to be paid by owners of a corpse once it was not buried within twenty-four hours. The amount continues to count daily.” Morticians are instructed to collect these payments before releasing the corpses for burial.

In response to the announcement, Sani remarked on X (formerly Twitter), “Taxing dead bodies in Enugu finally means people can no longer rest in peace,” highlighting the absurdity of taxing those who have passed away.

Enugu Government Defends Mortuary Tax

In defense of the Mortuary Tax, Emmanuel Nnamani, the Executive Chairman of ESIRS, explained that the tax was introduced to bolster the state’s revenue generation efforts. He emphasized that this tax had existed in some form for years and is not a new imposition.

Nnamani clarified that the tax is only ₦40 per day, contrasting it with the misleading notion that it was ₦40,000. He stated, “It is an indirect tax paid by mortuary owners, not deceased family members, and it is just N40, not N40,000. Since its introduction, nobody has been denied burying their dead ones.”

He further elaborated that if a corpse remained in the mortuary for an extended period, such as 100 days, the total tax would amount to ₦4,000. Nnamani indicated that the tax aims not only to generate revenue but also to discourage prolonged storage of deceased individuals in mortuaries.