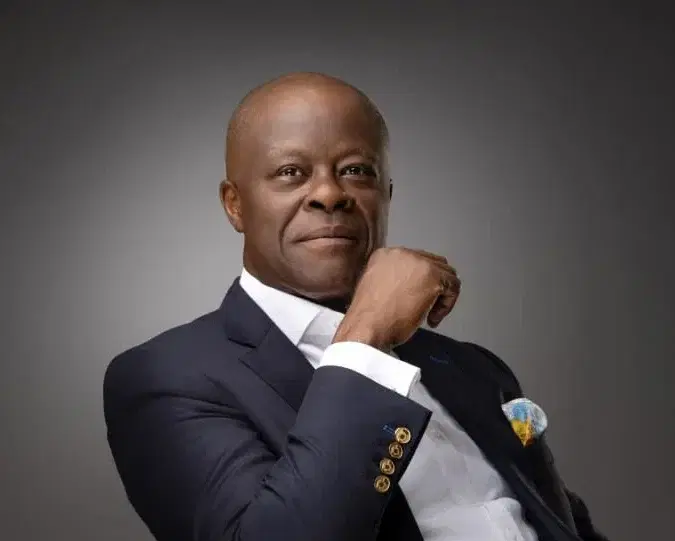

The Minister of Finance and Coordinating Minister of the Economy, Mr. Wale Edun, has announced that the federal government will implement a 15% Value Added Tax (VAT) on luxury goods. He confirmed that the complete removal of fuel subsidies took effect last month.

During a meeting with investors at the ongoing IMF/World Bank Annual Meetings in Washington DC, Edun explained that a bill currently before the National Assembly aims to establish a tiered VAT system where wealthy Nigerians will eventually pay a 15% VAT rate on luxury items.

He clarified that the poor and vulnerable segments of the population will benefit from lower or zero VAT rates on essential goods. A list of these essential items, which will be subject to zero VAT, will be made public soon.

Edun emphasized, “President Bola Tinubu is committed to implementing difficult but necessary reforms while protecting the poorest and most vulnerable. VAT is an efficient tax, and the upcoming bills will increase rates for luxury goods while exempting essentials for low-income individuals.”

Additionally, Edun expressed optimism regarding the oil sector’s potential to enhance foreign exchange inflows, citing improved security in oil-producing regions and new investments, particularly from Total and ExxonMobil.

He reiterated that the full removal of the fuel subsidy became effective in September 2024, stating, “Savings from the subsidy will have a more significant impact on the economy going forward, with the complete removal having occurred only last month.”