“He is a fool who trusts to luck; one should play a safe game.” — Leo Tolstoy, VANGUARD BOOK OF QUOTATIONS.

“Fools rush in where angels fear to tread.” — Alexander Pope, VBQ

In times of economic uncertainty, the wisdom of past sages becomes essential. Throughout history, there have always been those willing to exploit the naïve, especially during crises. In the current economic downturn, the potential for deception is at an all-time high, as opportunists promise miraculous financial solutions that often lead to greater poverty while enriching themselves.

The primary responsibility of the media is to protect the public by providing accurate information and education, enabling informed decisions in the face of economic predators. Central to this discourse is the banking sector, which has recently become a focal point of concern, particularly with the alarming rise in non-performing loans (NPLs).

BANKING: ALL THAT GLITTER IS NOT GOLD

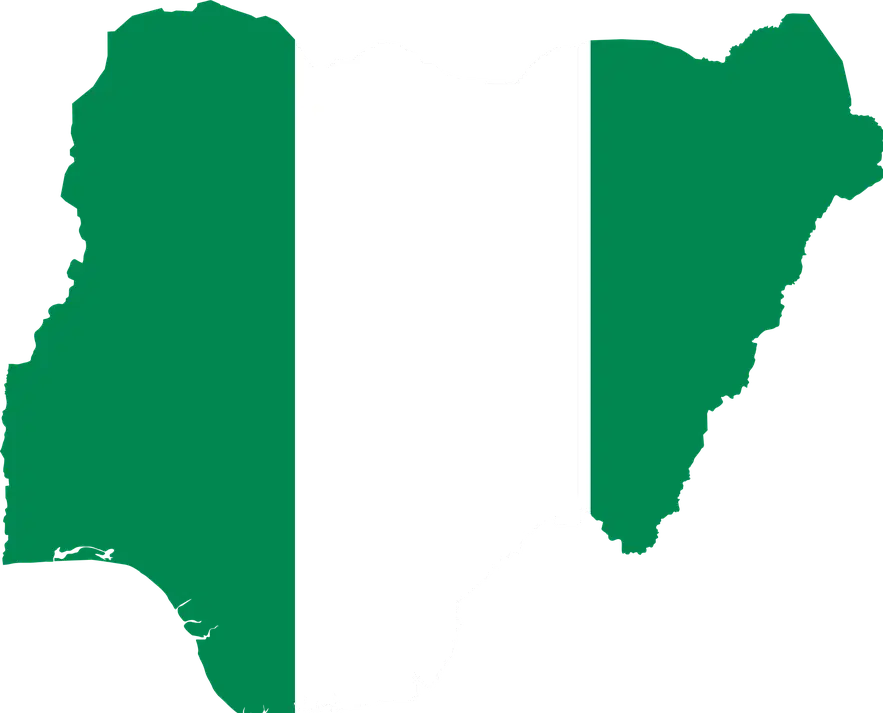

A recent report from the World Bank warned of Nigeria’s NPL ratio rising to 5.10%, surpassing prudential limits. This warning underscores the precarious situation of the banking system, eroded by high inflation, a depreciating naira, and a deteriorating capital buffer. While banks advertise impressive profit increases, the underlying reality is far less reassuring. In an effort to meet capital requirements set by the Central Bank of Nigeria (CBN), banks are now scrambling to raise funds in the capital market, which could lead to misleading portrayals of their financial health.

Historically, Nigerian banks have resorted to swindles to appear solvent, as seen in 2005 when they issued IPOs promising inflated profits and dividends. Fast forward to today, the same institutions are back in the market, often under the management of individuals with a history of financial manipulation. The public is left to bear the consequences of past mismanagement, particularly the staggering N5 trillion in toxic loans still being dealt with by the Asset Management Corporation of Nigeria (AMCON).

The growing NPL crisis is a ticking time bomb, worsened by rising interest rates and declining revenues. The banking sector has yet to fully disclose the extent of its NPL issues, which could spiral further out of control.

A CAUTIOUS APPROACH REQUIRED

This deception regarding the capital base of banks has been exposed by the World Bank. The CBN’s attempts to maintain a stable official exchange rate have failed miserably, leading to a widening gap between the official and black market rates. As a result, a bank that was once valued at N10 trillion is now worth a fraction of that—merely $6.25 billion.

The call for caution is clear: during these times of economic vulnerability, individuals must navigate financial decisions wisely, resisting the allure of quick fixes that may lead to greater losses. The wisdom of Tolstoy and Pope resonates profoundly; trusting in luck can be a fool’s game. Only through informed choices can Nigerians protect themselves from the looming threats posed by economic instability and exploitation.