The Federal Government of Nigeria has dismissed rumors of an imminent increase in the Value-Added Tax (VAT) rate from 7.5% to 10%. Finance Minister Wale Edun made this clarification on September 9, 2024, during a statement addressing the issue.

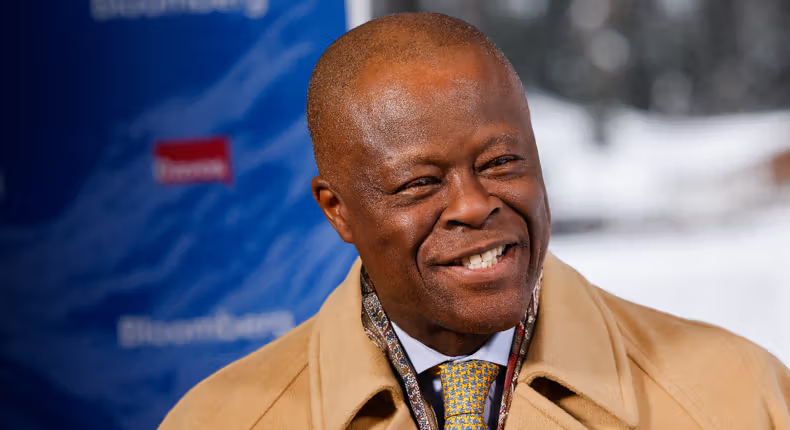

Edun, speaking from the World Economic Forum (WEF) in Davos, Switzerland, emphasized that the current VAT rate of 7.5% is maintained in accordance with existing tax laws. He reassured that there are no plans to alter the rate, and the government remains committed to adhering to the stipulated tax regulations.

“The current VAT rate is 7.5%, and this is what the government is charging on a spectrum of goods and services to which the tax is applicable,” Edun stated. He criticized reports suggesting that the government is planning to increase VAT, arguing that such claims misrepresent the government’s intentions and contribute to undue panic.

Edun elaborated on the government’s fiscal policies, asserting that their focus is on promoting sustainable economic growth and reducing poverty rather than imposing additional financial burdens on citizens. He also noted that recent measures, including the suspension of import duties and taxes on essential food items, aim to ease economic pressures on Nigerians.

“For emphasis, as of today, VAT remains 7.5%, and that is what will be charged on all VAT-able goods and services,” Edun concluded.