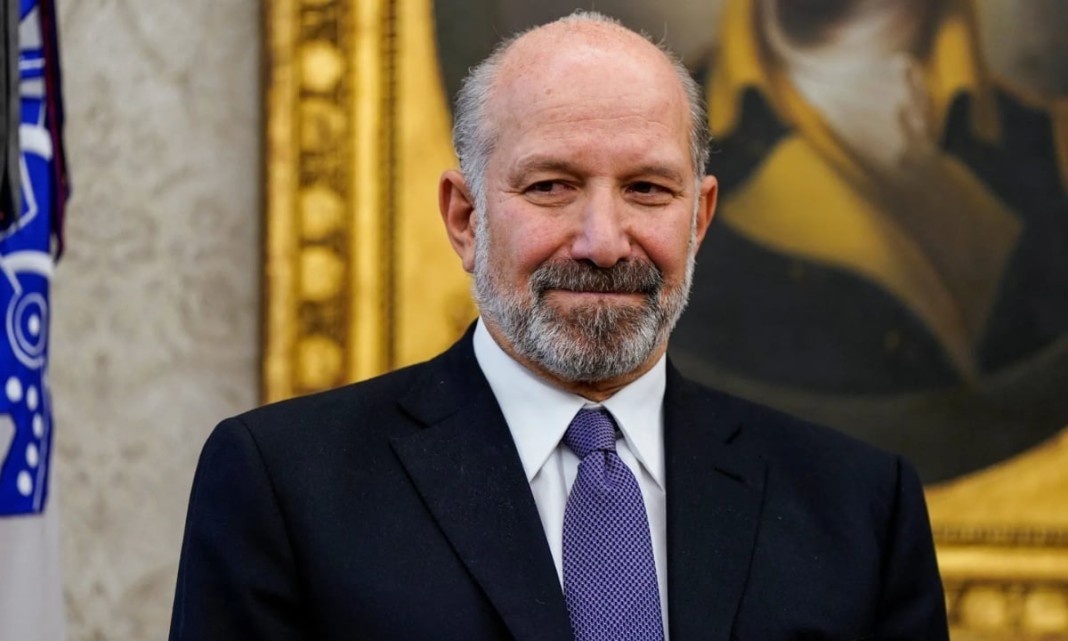

Howard Lutnick, the United States Commerce Secretary, has made some notable statements about former President Donald Trump’s intentions regarding the IRS and taxes. Lutnick explained that Trump’s goal is to eliminate the Internal Revenue Service (IRS) and replace it with something called the “External Revenue Service” to manage foreign revenue, particularly through tariffs. This would involve making foreign entities bear the financial responsibility, rather than domestic taxpayers. Additionally, Trump’s broader tax reform ideas, including potentially abolishing federal income taxes, align with his “tariff and tax foreign nations” philosophy.

It’s also interesting that Lutnick mentioned using Elon Musk’s approach to tackling waste and fraud as a strategy to cut spending, which might play into reducing reliance on the IRS.

With Trump’s executive orders, including the one cutting benefits for illegal immigrants, it seems clear that he is continuing to push forward with his plans for economic and immigration reforms. The tariffs on autos, semiconductors, and pharmaceuticals are part of this strategy.

How do you feel about these proposals? Would such drastic changes impact the U.S. economy significantly, in your opinion?