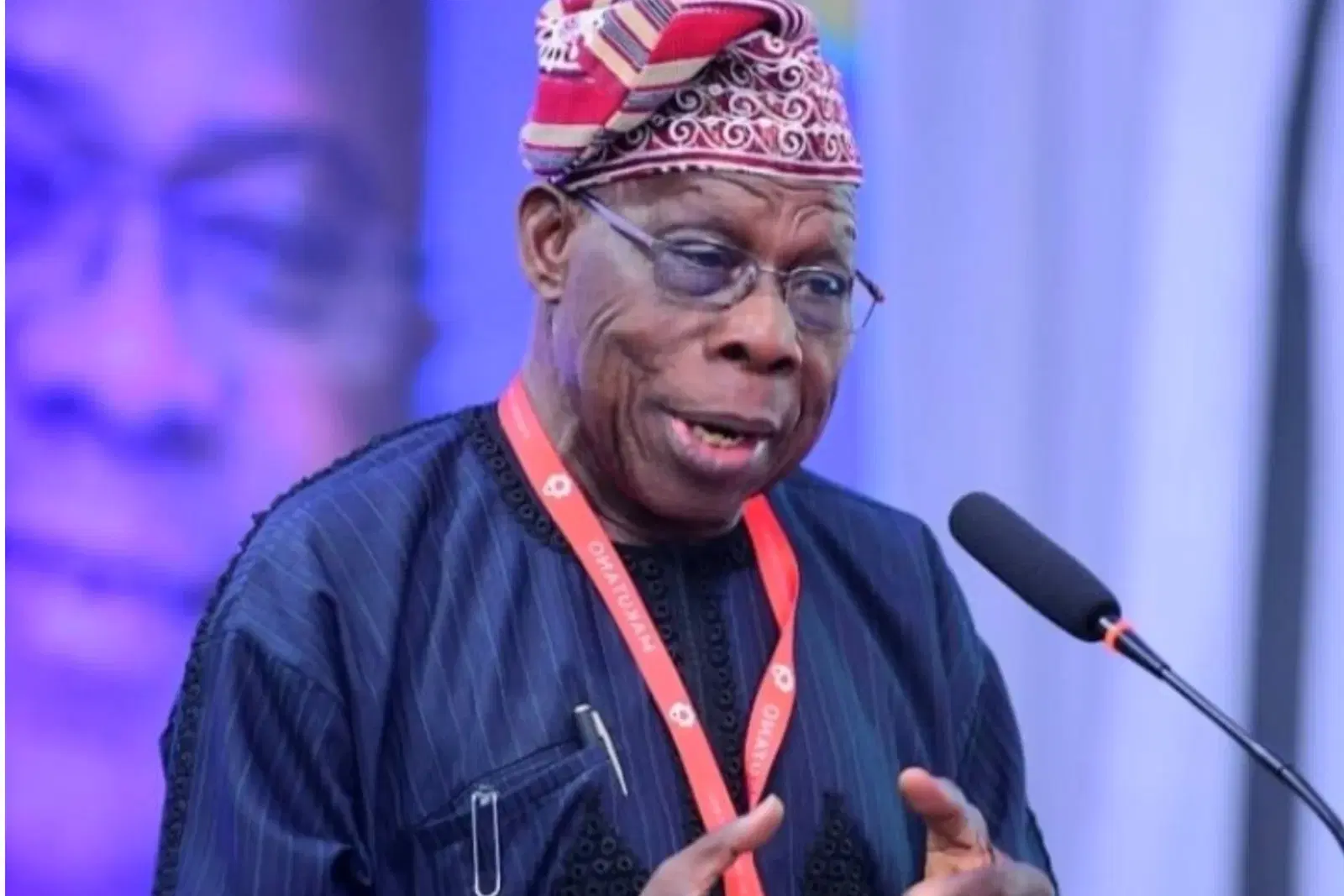

Former President Olusegun Obasanjo has shared insights into the strategies he employed to secure substantial debt relief for Nigeria during his administration from 1999 to 2007. He attributed part of this success to the establishment of the Independent Corrupt Practices and Other Related Offences Commission (ICPC) and the Economic and Financial Crimes Commission (EFCC), which helped to reassure creditors of Nigeria’s commitment to reform.

Upon assuming office, Obasanjo faced significant challenges, including a staggering debt servicing burden of $3.5 billion annually and a total national debt of approximately $36 billion, while Nigeria’s reserves were a modest $3.7 billion. He successfully negotiated debt forgiveness by convincing international lenders that the funds saved would be redirected toward developmental projects aimed at sustainable growth.

He emphasized that presenting a credible and transparent plan was crucial, as global financial institutions required assurances that any forgiven debt would lead to positive development outcomes. Reflecting on the current leadership landscape in Nigeria, Obasanjo expressed concern over a perceived decline in ethical leadership and effective planning.

“When I became elected President of Nigeria, one of the things that worried me and that I wanted to do something about was debt relief. The quantum of debt that we were carrying, the burden was too heavy. We were spending $3.5 billion to service debt, yet the quantum was not going down and I believed that we should seek debt relief,” Obasanjo stated.

He noted that many both inside and outside Nigeria viewed his ambitions as unrealistic, but he remained resolute. He engaged with the World Bank and international creditors, revealing that understanding the lenders’ perspectives was key to making a successful case for debt relief. He stressed that genuine reform efforts were necessary to earn the trust of global financial institutions.